June 15, 2022

Rae Oliver

Until quite recently, most organizations viewed climate management risks as a topic of concern for government departments and non-profit organizations. However, this stance is changing rapidly. Global legislation, political movements, and technological advancements have put climate risk at the forefront of the global business world. Not to mention market disruptions, extreme weather occurrences, and consumer attitudes.

The way that businesses report on climate risk is becoming more closely scrutinized. Especially as investors seek out new ways to measure and assess business models’ impacts on both the environment and organizations’ reputations.

In this day and age, climate risks are becoming not only environmental topics but issues that have direct and tangible impacts on businesses’ reputations and financial standings. Businesses and organizations across industries need to clearly understand the importance of climate risk in relation to their operations. Only then can they implement the strategies required to transform risks into opportunities.

Read on to learn more about how climate management risks are driving investment decisions.

Climate change is arguably one of the most pressing issues of our time. And it’s one that is already impacting the finances, operations, and lives of millions. The latest Global Risks Report from the World Economic Forum released in January 2020 stresses the impacts of global warming. The report notes that it has a global reach and will bring with it grave consequences. In fact, climate change is expected to put around 2% of global financial assets at risk by 2100 – or as much as 10% of these assets in a worst-case scenario, according to the European Risk Management Council.

This is why it is essential for organizations to prepare and invest in robust climate risk management strategies in place to mitigate these projected impacts. The financial implications and sheer scale of climate change’s potential impacts need to feature among key considerations for risk executives.

These risks are driving investment decisions and prompting investors to address climate change in innovative ways. Research shows how investors are considering how global warming is disrupting global markets and economies. They are responding by prioritizing organizations’ ability to create sustainable, long-term financial returns based on streamlined environmental, economic, and social systems. Investors are now evaluating their investments according to key industry benchmarks to make more sustainable investments that don’t cost the earth.

Organizations like the Task Force on Climate-Related Financial Disclosures aim to encourage and improve global reporting of climate-related risks and financial information. Financial markets and investors require clear, concise, and high-quality information on the potential impacts of climate change This includes information about the risks and opportunities posed, optimal climate-related policies, and emerging technologies in the modern world. The TCFD provides valuable data to investors about what industry-specific organizations are doing to mitigate climate change risks to drive sustainability and change throughout key sectors.

According to the Swiss Re Institute, climate change could cause losses of more than 18% of the global GDP by mid-century if mitigation efforts are not pursued. The US and Europe’s economies could shrink by as much as 10%, while China’s economy could shrink by as much as a quarter.

These are the four key areas of risk associated with climate change that organizations need to consider:

The impacts of global warming are expected to affect every country on the planet. Due to increasing development and urbanization in high-risk areas such as flood plains and coastlines, there is more physical property at risk.

This risk requires organizations to work closely with insurance brokers to offset some risks. All while designing and building more resilient infrastructure to withstand extreme weather events.

Organizations and investors alike need to be prepared for ongoing supply chain disruptions in the face of our warming planet. Business continuity plans will need to consider this increased risk.

Well-prepared organizations will be able to navigate supply chain disruptions and supplier changes. Using internal data and a wide range of other data sources allows for the creation of clear, transparent, and adaptable value chain management plans.

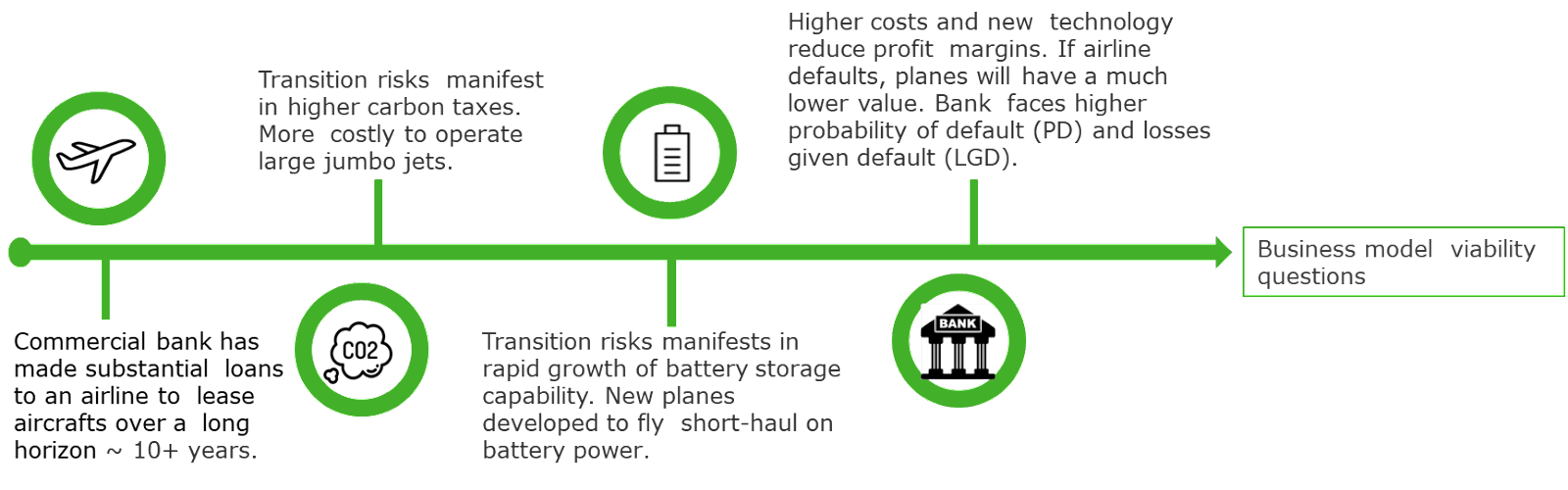

Transition risks are posed alongside physical risks and major policy changes often follow significant disasters and emergencies. Avoiding the worst of the climate catastrophe will require significant effort across industries to lower greenhouse gas emissions.

Certain industries will be hit harder by carbon and industry-specific taxes than others. Moreover, transitioning to more sustainable production and operation measures and climate-resilient solutions will be easier for certain sectors. These transitions will take time and pose unexpected costs, especially for organizations that do not have climate management risk plans in place in advance.

Organizations’ attitudes toward Environmental, Social, and Governance (ESG) issues are increasingly being considered liabilities. Growing investor and consumer scrutiny are pressuring organizations to take responsibility for their social and environmental impacts and put more sustainable practices in place.

Underwriters are paying more attention to ESG risks. This means that businesses need to make even more use of advanced technology and data to understand their impacts and exposure. This data can be used to make positive changes and mitigate investors’ climate change risks.

Although climate change poses a myriad of challenges, addressing these challenges may create valuable opportunities for organizations and investors alike. For instance, the costs of low-carbon technologies like photovoltaics have dropped by as much as 85% over the last decade. In 2020, renewable power was projected to be cheaper, on average, than coal-based power on a global scale. This makes fully hybrid vehicles, LED lighting, and other green technologies more cost-effective to run and more carbon positive as well.

Portfolio companies are now being increasingly encouraged to invest in alternative energies, such as solar and wind power, that can replace fossil fuels. This is done by financing or evaluating decarbonization opportunities across portfolios. Financial organizations are in a strong position to allocate resources towards energy-efficient alternatives by introducing renewable energy financing schemes and establishing financial incentives for emission-lowering projects.

Thus, while the risks are significant, climate change presents organizations with numerous opportunities to work towards the goal of creating a healthier planet and winning consumers’ trust. The key to making the most of these opportunities is to act rapidly while prioritizing adding ESG investing to their analysis processes.

Organizations across industries may identify a need to develop climate change risk mitigation strategies. But they often lack the tools and data needed to shape their policies and accurately report on risks and emissions data.

Climate-risk software analytics tools like SINAI can assist these companies in understanding the risks of climate change, how it has the potential to impact them, and what they can do to mitigate these risks.

SINAI helps your organization to reach your net-zero targets following the Science Based Targets initiative’s guidelines and principles. Our platform provides leading decarbonization solutions to quantify and report on targets, carbon pricing, and build robust risk management strategies.

Use our enterprise software to measure, analyze, and reduce emissions to meet your investors’ climate change goals.